Imperialist retirement?

(No. 97) It's all you can afford, but that doesn't mean you should do it, by Stephen P. Williams

I love New York, SoHo, NYC, photo by Stephen P. Williams

Is your future determined by the cost of living?

I’ve lived in New York City 36 years. In that time I’ve spent so much money and have witnessed or endured so many indignities that I suspect I’ve been under a spell. Should I break the ineffable hold the city has on me by spending the final third of my life somewhere else? I am not going to make that decision today, but I do think about moving.

https://www.visualcapitalist.com/

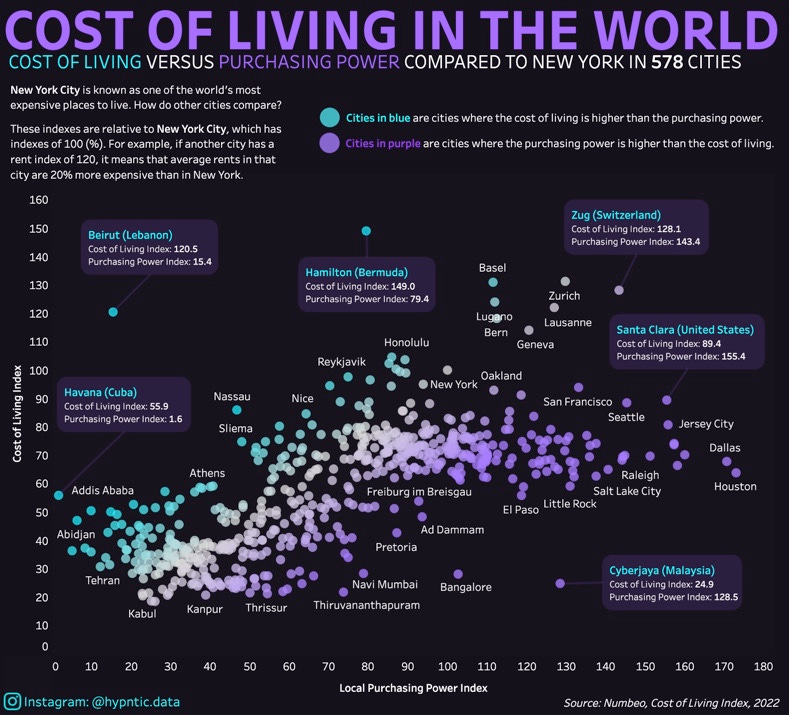

The chart, above, from Visual Capitalist, is provocative in this regard. It makes me wonder about the advantages of retiring overseas (though I expect to continue working from wherever I land), and also about the ethics of moving overseas. Over the years, I lived for periods in Guatemala, Ecuador and Japan, so I have enough experience being an expatriate to question whether that experience suits me now.

Each time I’ve lived overseas I’ve leveraged being an American into a pretty cushy life, by local standards. Looking back, I question my assumptions about paying low local wages while I’m living on dollars, and the freedom I felt, as an American, to go wherever the hell I wanted. I would not want to repeat that relationship, but I’m not sure an American can move overseas and avoid it.

In the chart, I’m drawn to Thiruvananthapuram, located in Kerala, which I’m told is one of the most inviting states in India. I’m pondering this city because I’m wondering how older Americans might be able to live decently in retirement just on their social security payments. I just this month realized I’m eligible for social security, since I’m 64.5 years old. Because the monthly payments increase each year a person waits to claim them, I won’t be taking them soon, although I’m not sure that’s mathematically logical. I doubt there’s any way to game the actuarial tables the government uses to calculate payments.

To determine when to start receiving social security, we older people have to calculate one simple thing: how long till I die? If I’m going to die at 72, I should start collecting lower payments now. If I’m going to live into my 90s, I should wait until the maximum age of 70, to collect 35 percent higher monthly payments. Let’s say I’d get $2,000 a month if I were to retire right now and live to be 90. My cumulative monthly payments would amount to $600,000, assuming I didn’t invest them. If I instead started receiving $3,200 a month when I was 70, I’d end up having received $768,000 at age 90. So if I wait, and live long, I’ll receive $168,000 more than if I start now. That’s a lot of bunion tape.

There’s another element: earnings. Benefits are based on your 35 highest earning years — the more you earn, the more you get when you start collecting social security. So if I think I’ll earn tons of money in the next five years, I should wait and let those figures lift my monthly payments even more.

Deciding when to collect social security is a crapshoot. There’s no right answer, because no one knows when they are going to die. (If any of you have a different take — especially a smarter, more nuanced one — please share it in the comments.) But no matter your choice, Social Security payments will never offer more than a poverty level existence in the US.

Once I retire, which might be never if my typing fingers continue to respond to my brain signals, I need to decide where to live. In the chart above, New York represents the baseline. All the cities below New York are cheaper, those above are higher. So I won’t be retiring to any of the high cities, such as Honolulu, Zurich or Reykjavik, although i’d be happy to land in any of them. At the moment, my druther is Manhattan, where I now live. I love the connections I have here. The privacy. And the stimulation of the streets. Sure, museums are nice, but I love seeing the people, watching the dramatic skies, and pondering existence as the rivers flow by. Plus, bookstores and Russ and Daughters smoked fish.

I would be overjoyed if I could live here, and spend several months a year out in Montana, or Italy or Patagonia. But none of that will happen on Social Security payments alone. Which makes me wonder where an American these days can retire on just government payments.

I want to make an intentional decision about where to retire, if I ever retire. It blows my mind that I’m thinking about this phase of life, but that’s where I am: in the final third. And you only get to live the final third once. (I believe I read that on TikTok.)

Scanning the cities in the lower quadrants of the chart, my eyes rest on Thiruvananthapuram. According to a cost of living database called Numbeo, I could probably retire to Thiruvananthapuram and live well enough on just my social security payment. I might even be able to save enough to visit my kids in the states every year. The average salary in the city is less than $1,000. A one bedroom apartment in the city center is $200 or less. A pair of Levi’s is $35. A gym membership is around $20 monthly. A dozen eggs cost $1. Numbeo estimates a family of four has to spend $1,000 a month for a decent life. The costs are appealing. But there are drawbacks, besides being far from my kids, and these would apply to most foreign destinations, from Patagonia to Lagos:

I have never been to Kerala, though I’ve heard wonderful things about it.

I do not know anyone in Thiruvananthapuram.

I do not know anything about the culture of the city.

I speak only English and Spanish.

I don’t know the cost of healthcare there.

I am not comfortable being a cultural imperialist, with plenty of money to spend for no good reason other than that I was born in the USA. Decades ago I lived like this for a while in Latin America, and in retrospect, I don’t think it’s an honorable way to live.

I doubt I will move to Thiruvananthapuram, or Mexico City, or even outside Taos — all places I’ve seriously considered. I will probably continue with my naive faith that everything always works out, and that money always arrives somehow, and, anyway, I am willing to downsize and spend far, far less, to just stay in Manhattan, one way or another.

It’s gonna be while, if ever, before I make a decision. How about you?

I think this is a rich topic, and that all of us have differing, interesting ideas about how to approach retirement. Please share yours in the comments, so everyone can learn from your situation.

Old people are funny

Read all about it here.

I believe these old bristlecone pines deserve our empathy, and action.

Let me know what you are thinking about aging these days. Post in the comments, please. — stephen@stephenpwilliams.com